Can startups remake the future of patient payment?

Revenue cycle management isn't going away, but a few companies trying to change the system might make it better

I’ve been writing a lot about expensive specialty medications. This week, I’m pivoting to talking about startups that help patients handle expensive medical care.

First, I don’t think anyone would disagree with me that the fact that these startups are needed is sad. In a world where everyone had health insurance and the insurance covered most major treatments, TailorMed and Cedar wouldn’t exist. I suspect the founders would be okay with that.

But unfortunately, that’s not how the U.S. system works. Many patients—particularly those diagnosed with cancer—face financial toxicity, or a spiraling burden of medical debt that can lead to bankruptcy or avoiding aspects of treatment for fear of the cost.

Beyond financial toxicity—the system just sucks

Short of causing bankruptcy, the way we do billing in the U.S. is confusing, outdated, and weird. After the patient receives a service, whether an office visit or procedure, the provider submits a request for reimbursement (a claim) to the patient’s insurer. (Note that this example is for privately insured patients. The process is largely the same for patients on Medicare/Medicaid. Patients without insurance typically just get the full bill.) The insurer outsources the reimbursement process to a payment provider like Zelis or OptumPay, entities that may fight with the provider over the amount of reimbursement to be given. After this fight is concluded, the provider gets their cut, and the patient finally gets a bill.

From the patient perspective

It may be months later that the patient gets a bill. They usually have no warning that a bill from a procedure they may barely remember is about to show up. And once it shows up, it has a due date—which, depending on the provider, may or may not be entirely arbitrary.

This is where patients run into some perverse incentives. If you ignore that bill, the provider might just write off your debt. (This is more common with huge entities—I once owed LabCorp something like $800 because they declared a panel of Crohn’s bloodwork “experimental,” we played chicken over it, and they…never actually charged me.) Or the provider might send you straight to collections, and those people do not mess around. Either way, the provider doesn’t get what they’ve deemed is their full worth for the visit or procedure.

From the provider perspective

For providers, managing this whole wonky process is called “revenue cycle management.” The system requires a high-touch approach from the provider’s office, and there may be a long lag time before the provider is reimbursed. (I’ve written before about how cash-pay care can get around this, and I’m excited about what new virtual care companies can do to upend this system as well. However, traditional, in-person procedures aren’t going anywhere anytime soon.)

The lag time stretches even longer when there’s a patient pay component—as discussed, the patient may not even see a bill until months after a visit, and then it may take them additional months (or even years) to pay off their portion.

When you’re a big health system or provider, you typically have an internal office managing your revenue cycle, you might have some outside contractors, and you likely have the patient volume and budget necessary to stay afloat for a while. Put another way, each individual reimbursement matters less.

But when you’re a smaller provider or even a single doctor in practice (which is becoming less common by the way, partially because of the complexities of revenue cycle management and the companies that exist to make money off of making it even more difficult), each reimbursement matters more. This is heightened if you’re a provider like a GI doctor or perhaps an OB/GYN, who performs a decent number of procedures in addition to office visits. (Procedures pay much better/are more expensive for the patient and are subsequently more important for the revenue of the practice/may take the patient longer to pay off.)

TL;DR

There’s definitely a market for a company making this system easier, more transparent, and more patient- and provider-friendly. (Note that this isn’t a comprehensive overview of revenue cycle management companies—that’s a much bigger space. This is an overview of newer startups seeking to change the patient payment aspect of revenue cycle management.

Optimizing the existing network of assistance

There is, as I’ve written before, an existing network of patient assistance programs, pharmaceutical rebates, and charity help. But these can be hard, if not impossible, for the patient to cobble together.

Some providers, like the cancer care center highlighted in TailorMed’s case study, do this work manually—and have for years. But there’s also a clear-cut case for software assistance, and so this category of patient financial assistance startup was born.

There are a few companies in this category. The best-known are Vivor and AnnexusHealth.

This service is undoubtedly useful—and brings what we used to call at my consulting firm a “halo effect” to the providers that offer the service to patients. But it seems inevitable to me that there’s a market cap on this. Not every provider needs this service, and I’m sure there are quite a few that have their own lists of patient assistance programs and so don’t feel the need for software help with it.

The effect for the provider itself also feels limited. The patient gets assistance on their out-of-pocket costs, but that doesn’t mean the provider gets more revenue. Maybe it means the patient continues with treatment when they wouldn’t have otherwise, but that seems dubious when you’re talking about cancer care. Anyway, I guess I’m skeptical about providers offering a service that’s probably a moral good but doesn’t materially change their process.

Furthermore, it’s unclear to me what the differentiator is for the various companies offering this—there are only so many charities out there.

Optimizing the patient payment plan

The category with—in my opinion—greater value add and room to grow is in optimizing the patient payment plan. Rather than hitting the patient with a hilariously large bill, providers that work with startups in this category can offer payment plans and user-friendly billing portals (as opposed to the typical provider billing portal, which looks like it was built in the 90s).

In this space, you’ll find startups like TailorMed (which also offers patient assistance program help) and Cedar.

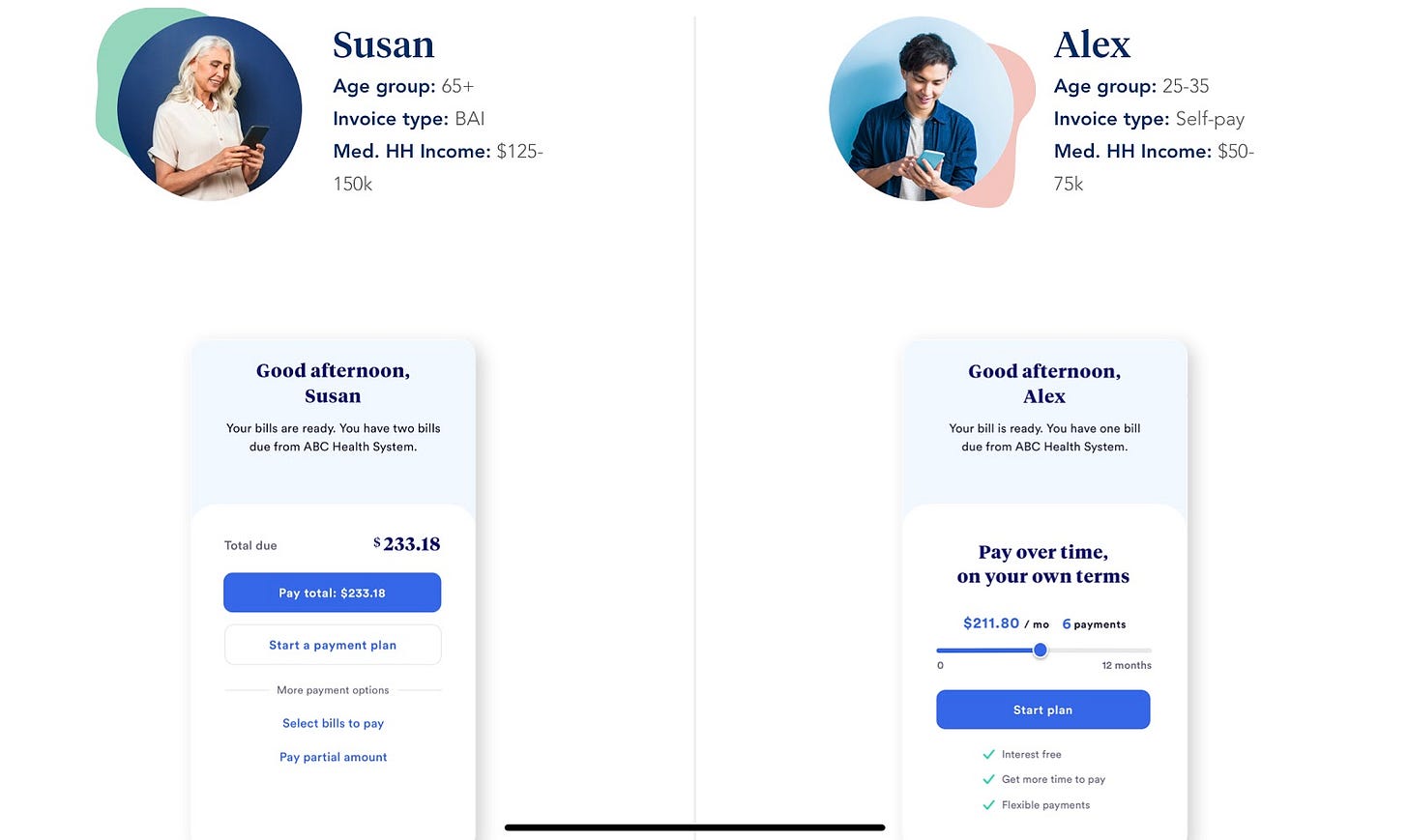

Cedar is particularly interesting to me because of its recent huge raises and its acquisition of OODA, another startup in this space. Based on their marketing, Cedar seems to offer payment plans based on their client providers’ patient demographics (which seems both useful and potentially fraught with all of the ways that demographic data can go wrong).

And the OODA acquisition adds an interesting layer of trying to change the way patient billing is done. The company works with providers and insurers to streamline workflows and get near-instantaneous reimbursement for the provider from the insurer, putting the responsibility for patient billing on the insurer.

I’m interested to see how Cedar and OODA work together—in their words, by “aligning providers and payers around the consumer.” It seems like an exciting play to remake an outdated and onerous space.

Conclusion

As expensive procedures and prescriptions rise in frequency, the baby boomers hit old age, and high-deductible health insurance becomes a way of life, I…don’t see this space going away anytime soon.

I think Cedar has a good chance at owning the market altogether. They’re growing quickly, they’re providing a solution that appeals to both patients and providers, and the OODA acquisition gives them a chance to remake the complicated revenue cycle. The possibilities seem wide open. Unless they hit a demographics data scandal or the bureaucratic shoals of OptumPay, I have a lot of faith in Cedar.

Maybe someday we won’t need for this to exist, but until then, I’m excited to see these startups try to improve the status quo for patients.

This information shouldn’t be taken as investment advice (obviously), and the opinions expressed are entirely my own, not representative of my employer or anyone else.

Really well written and thanks for shedding light on this process and the players. I came across https://www.hellowalnut.com/ — its unclear to me whether its playing in the same space as Cedar. If you have thoughts on it, I’d love to know!