Clover Health is going public

But is it disruption or is it...another EHR?

One quick introductory note—my colleague Moe Tkacik wrote a great piece in the American Prospect on a depressing topic: how nursing homes became as terrible as they are, and how for-profit owners originated a lot of the tactics used by modern private equity in health care. I considered writing about nursing homes and private equity in this newsletter, but she did a far better job, so I’ll be moving on to this week’s topic: a new health care SPAC.

Clover Health, a Medicare Advantage start-up, is going public via a SPAC led by ex-Facebook investor (and regular talk show news guest) Chamath Palihapitiya.

The Clover SPAC is a little weird. As health care writer Kevin O’Leary noted in an extensive Medium post last week, the investor deck leaves out significant information. The deck was so spotty that it had O’Leary “yearning for the rigor of a traditional S-1 and IPO process.”

But besides the weird numbers, the most striking thing about the Clover SPAC is how they seem to expect their technology platform to disrupt health care—and disrupt it so much as to be worth a $3.7 billion valuation.

While it’s possible that Clover will use its technology to…disrupt, it seems much more likely that Clover’s investors are making the same mistake that investors have been making since the 1980s—wishfully thinking that “tech” alone can actually fix health care.

Medicare Advantage

First, a little bit of background. Clover is a Medicare Advantage company, meaning they sell plans to seniors that compete with the traditional Medicare plan offered through the government. MA is very popular, with about a third of all Medicare beneficiaries in the U.S. using it instead of original Medicare.

In general, MA plans offer a wider array of benefits (dental, vision) for about the same price. The one potential downside to MA is that the networks are narrower—original Medicare beneficiaries can visit any doctor or hospital in the U.S. that accepts Medicare, while MA enrollees are limited to a prescribed network—although that hasn’t stopped Medicare Advantage from being a popular offering.

MA plans are also carefully regulated and rated by Medicare, to ensure beneficiaries receive quality care regardless of the plan they’re on.

Which brings us to Clover, an MA plan with a 3-star rating. Which, as O’Leary notes, puts Clover in the bottom 13% of all MA plans.

So Clover is a poorly rated MA plan with a decent (~59,000) number of enrollees (although giant UnitedHealth Group added more than that to their MA plans just in Q3 2020), going public through a SPAC instead of a traditional and more rigorous S-1 process and receiving a giant valuation.

Two separate businesses

As O’Leary points out, the Clover investor deck seems to push two separate businesses. First, the MA business (as mentioned above, a poorly rated MA plan with a decent number of enrollees). And second, the ~tech business.

Given the blandness of the MA business, O’Leary concludes that the $3.7 billion valuation must be directly tied to the ~tech.

Medicare Advantage business

To fully understand how spare the detail is for the MA business, consider these examples:

The deck compares the MCR (medical cost ratio, or amount of revenue spent on patient medical costs) in all of 2019 to Q1 2020 without making it clear that it’s not quite a true comparison (especially since, generally, patient spend is lowest in Q1 and greatest in Q4)

Clover’s MA market share numbers are impressive—until you realize it’s just within the counties in which they already have more than 500 members

(footnote 4 reads: “Markets where Clover has over 500 members prior to AEP results. Represents 13 of our 34 counties.”)

The MA members appear to have been taken directly from the CEO’s former business, when he was head of CarePoint (in O’Leary’s words: “Prior to 2016 it appears as though Garipalli was testing out Clover inside of CarePoint. While Clover was citing almost 7,200 members in 2015, while Clover’s insurance license wasn’t in the Medicare Advantage enrollment files in 2015. CarePoint Insurance Company, however, was in the MA enrollment files (for 2013–2015), and had right around 7,200 members in 2015.”)

Incidentally, Clover CEO’s Vivek Garipalli was investigated for his former business CarePoint. Garipalli and his partners began CarePoint by purchasing three hospitals out of bankruptcy and running them as for-profits—and at some point, they appear to have paid themselves hefty management fees. One of these for-profit hospitals run by Garipalli was, at one point, the most expensive in the U.S.

For more thorough deep dive into Clover’s investor deck, I recommend the entirety of O’Leary’s Medium post.

Technology business

What struck me, though, was Clover’s ~technology.

The health insurance business is so technologically behind that even a good website could theoretically be viewed as a “disruption” to the industry. But Clover’s pitch seems to be more than a good website. Their slides mention savings coming from machine learning.

But based on my perusal of their deck, their technology seems to be more or less…another electronic health record.

The Clover Assistant appears to be software that lies on top of the existing EHR in the practice and delivers “actionable data” alerts. Except existing EHRs also deliver alerts, very similarly. And the current research shows that physicians ignore these alerts; the more alerts, the more they are ignored.

An alert from an EPIC EHR with a reminder to administer an annual flu shot. It’s unclear how Clover intends to improve on this (although EPIC is notoriously bad, so maybe the improvement is in a design that’s not Windows XP?)

There’s a world, perhaps, in which the Clover Assistant delivers an evidence-based treatment plan courtesy of machine learning that improves upon what a physician planned to do.

But Clover’s Medicare star rating is so low at least in part because their physicians are not very compliant with basic health metrics.

In other words, if the tech keeps patients healthy by doing a lot of preventive care…why is Clover’s flu shot compliance rate only 67% (in 2019, Medicare gave Clover a star rating of just 2 on this point)? That’s not a cherry-picked number, either. Its rate of adequately controlling blood pressure in its patient population is only 60% (also a 2-star rating). By my rough calculations, Clover is in the bottom 20% of all plans on both of these metrics. Clover was also awarded 2 stars on managing rheumatoid arthritis and improving bladder control, among others. All things that, seemingly, a machine learning platform could solve.

I would suspect that physicians just don’t use the software, although the deck seems to contradict that by showing us net promoter scores. Clover is to other EHRs as Netflix is to cable. (Except in the health care space, where providers don’t have the option of “cutting the cord” on legacy EHRs, Clover just…sits in a different window from the legacy EHR?)

No one’s disputing the negative NPS of legacy EHRs, though

I don’t want to be too mean to Clover. It’s difficult to build new things in health care, and investor decks are obviously glossy compared to reality. I want to see change, I suspect a lot of that change will come from good-intentioned start-ups, and maybe Clover just missed the mark.

But by missing the mark, they’re also pushing the narrative that a glorified EHR technology will disrupt the Medicare Market!

And by falling back on this, they’re not changing anything, they’re just adding to the list of software and alerts that physicians are forced to click through before they can actually treat their patients.

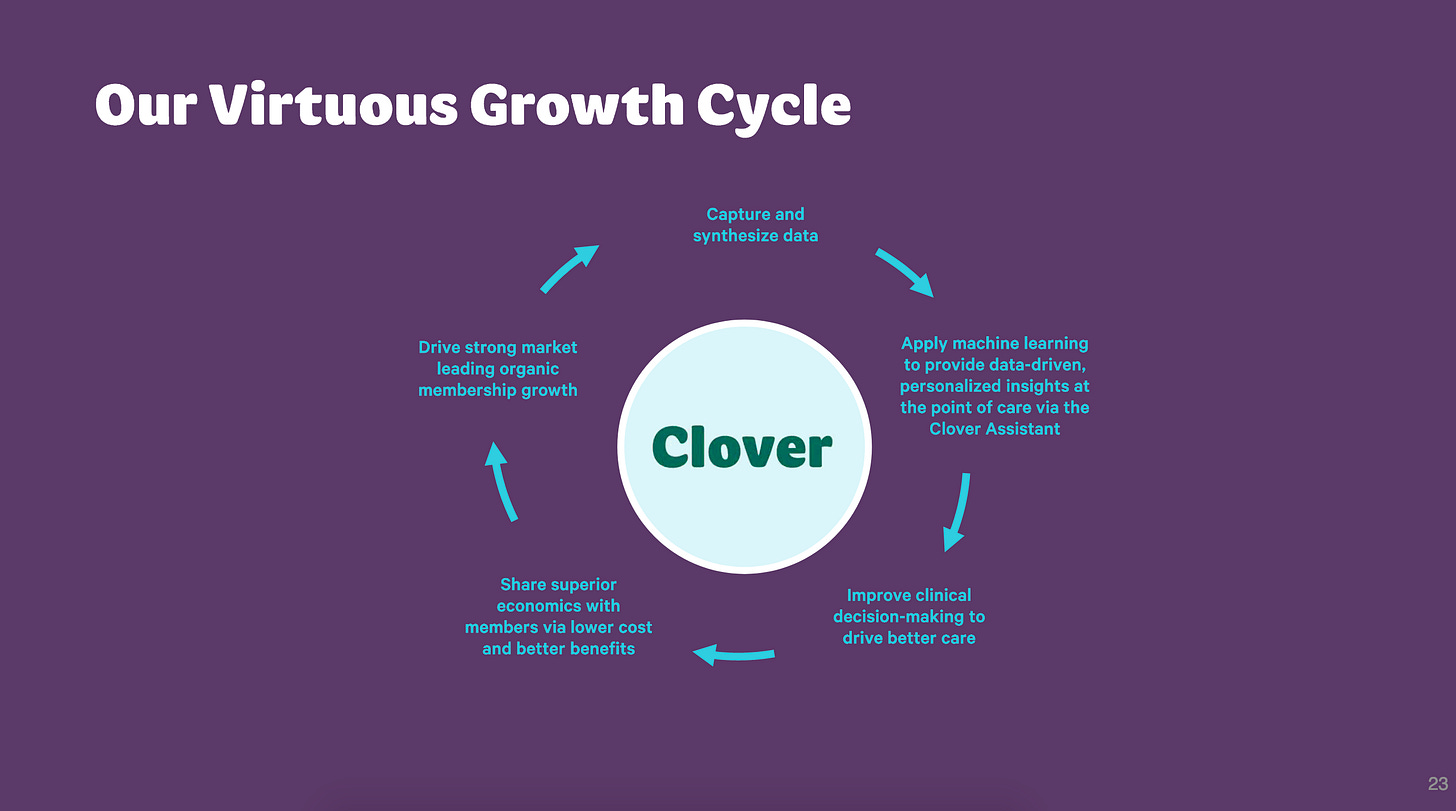

Their “virtuous growth cycle” is also nothing new. I would strongly argue that “improving clinical decision-making” is not the lever to pull to improve care (instead, I’d look to hospital prices, pharmaceutical prices, structural racism, Medicaid cliffs, overall consolidation…)—but also this has more or less been tried before.

Some version of this “virtuous growth cycle” has been sold to investors since Healtheon’s big idea of the health care triangle gave way to…WebMD, the site we all know and love not for its actionable medical insights but for convincing everyone they have cancer.

Forbes: When Jim Clark conceived of Healtheon in January 1996, the billionaire hero of Netscape and Silicon Graphics envisioned this new company at the center of a triangle. In one corner were the doctors and in the other two were patients and the payors--the government, insurers and HMOs.

CNN Money, 1999: Online medical firm Healtheon Corp. has agreed to merge with privately held WebMD Inc…The merger would create a consolidated Web-based medical services company that provides health care information to consumers and doctors…

Conclusion

I wish the Clover people and their investors the best of luck. If they can really root out unnecessary care in the senior population and replace it with a high flu shot compliance rate, I will gladly be wrong. But I worry that a CEO who has more or less disdained patients by charging exorbitant hospital fees has teamed up with investors on a less-than-rigorous SPAC, trying to “disrupt” health care by adding yet another piece of tech no one will use.

Bravo! Amazing analysis.

Their latest Medium article is funny too: "One of us — Vivek — is the son of two doctors".... one of whom is a convicted felon for healthcare fraud: https://www.justice.gov/sites/default/files/usao-nj/legacy/2013/11/29/GaripalliInformation.pdf

https://medium.com/clover-off-the-charts/founders-letter-who-we-are-and-why-we-exist-6d732266113e