How AbbVie usurped government regulators and created its own rule of law

The story of Humira, the world's bestselling drug, and the lawsuits trying to keep the biologics market competitive

One pen, $2,500

In 1994, BASF, a German chemical company, discovered a winning drug called adalimumab, one of the first of a new class of drugs known as biologics. BASF’s timing was remarkable; adalimumab targets autoimmune diseases, a category of illness that was becoming increasingly burdensome in the U.S. While originally approved for rheumatoid arthritis, adalimumab is also used for Crohn’s disease, ankylosing spondylitis, psoriasis, and other autoimmune illnesses. But adalimumab’s greatest advantage is that it was first FDA-approved biologic using proteins that were entirely human. Infliximab, adalimumab’s predecessor and original competitor, used mouse-human chimerical proteins that a patient’s body might reject or react to.

Today, adalimumab—packaged as Humira and sold by AbbVie—is the highest grossing drug in the world. In the U.S. alone, AbbVie raked in almost $13.7 billion on Humira sales in 2018. Globally, that figure was more than $18 billion—more than Monsanto or Visa. Normally, drug companies would only be able to maintain these monopoly prices for a few years, until the patent on the drug expired. When a patent expires, competitors can come into the market and reduce prices by selling a generic version of the drug.

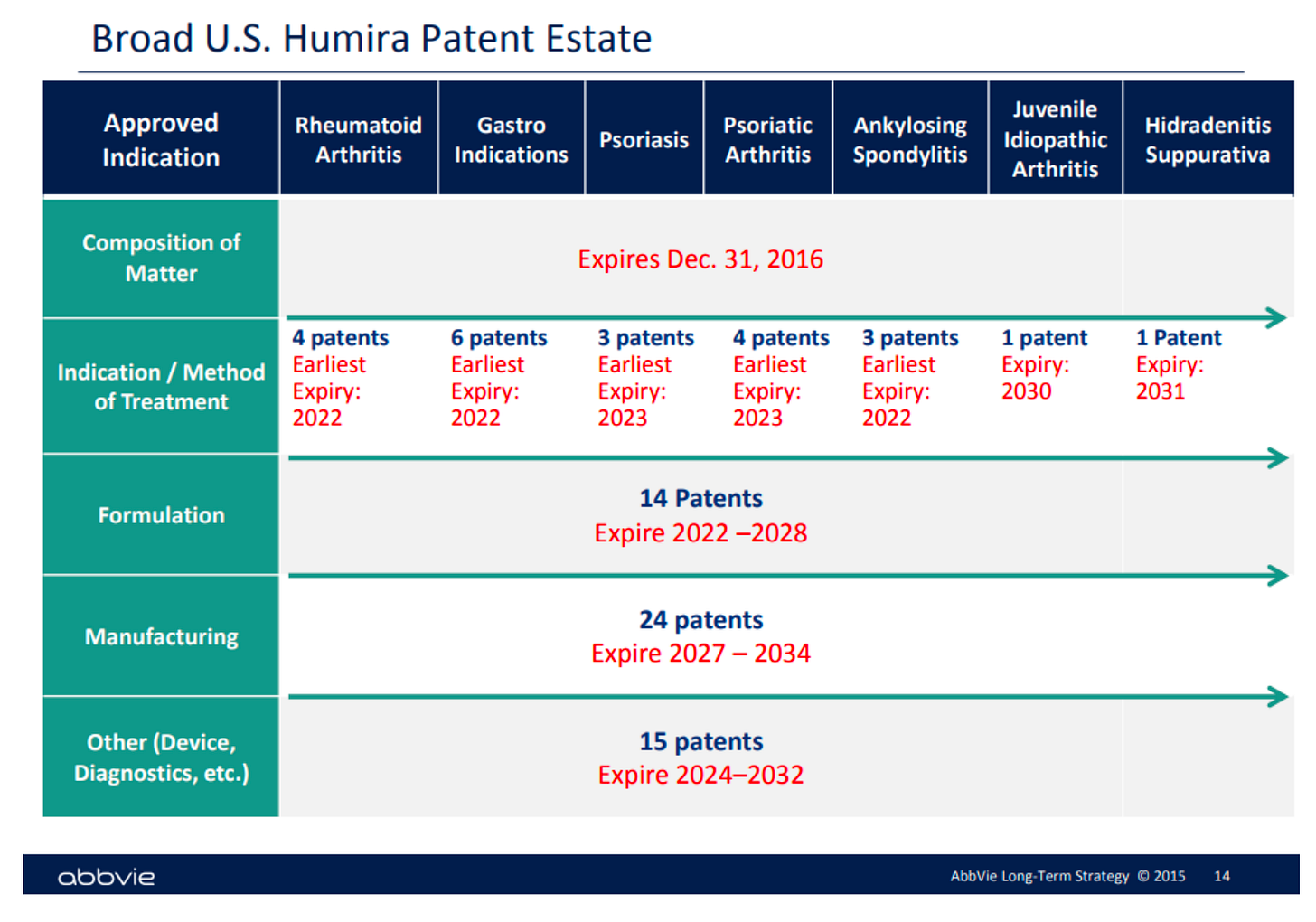

And this should have happened here; AbbVie’s original patent expired in 2016. But the corporation gamed the system. As the original patent neared expiration, AbbVie’s lawyers began filing for hundreds of patents for minute changes. Most of these patents were filed after 2014: AbbVie obtained 32 patents in 2015, and 21 in 2016. In a 2015 strategy slide deck, AbbVie bragged about its “broad patent real estate” on Humira. This so-called patent thicket created obstacles to competitor drugs that were so high that AbbVie became a de facto regulator of what drugs are permitted to be sold to the U.S. public.

Image source: https://www.labaton.com/hubfs/Filed%20Humira%20Complaint.pdf

Patent thicketing is not new. But its application to biologics sets a dangerous precedent. Because biologics are more complicated to manufacture than standard drugs, there are many more steps that a corporation can try to patent. And the existing patent system is unprepared for the deluge of patent thicketing that lucrative biologics are likely to bring about.

If AbbVie’s patent thicketing strategy stands up in court, it sets a precedent for biologics that are perpetually on patent and always sold at monopoly prices. In fact, after a research analyst for Sanford C. Bernstein & Co. saw AbbVie’s strategy displayed, he said, “I’m pretty sure every CEO in biopharma sent that to their head of IP [intellectual property] and said, ‘Can we do that?’”

The story of how Humira became the world’s bestselling drug, then, is a story of a monopolist taking advantage of a weak legal framework in the midst of changing medical technology.

-

Humira is expensive, costing an average of around $50,000 per patient per year. It is an effective drug used for a broad array of autoimmune illnesses. And Humira patients have to self-inject frequently, from once a week to once every other week. Typically, patients on the drug are expected to use it for the rest of their lives.

Humira is part of a class of drugs called biologics, which are manufactured using biologically engineered cells (rather than, say, the chemical reactions used to create atorvastatin, Lipitor’s active ingredient). Biologics are a fairly recent invention, with the first biologic insulin available in 1982. Biologics generally treat autoimmune illnesses, since they’re designed to replace (in the case of insulin) or inhibit (in the case of Humira) chemical cascades in the body.

The fact that biologics are made with human cells rather than pure chemicals complicates the process of making generics. When Lipitor, for example, went off patent in 2011, competing manufacturers could simply engineer a process to make the chemical compound atorvastatin and package it in their own pill forms. But because biologics involve cell engineering and produce such large proteins, there are too many variables to create an exact copy of the medication. In the image below, for example, aspirin is a much smaller and simpler molecule than pembrolizumab, a biologic. It’s much easier to create an exact copy of aspirin than it is for insulin or pembrolizumab. So instead of “generics,” competitor copies of biologics are called biosimilars.

Image source: https://theconversation.com/biologics-the-pricey-drugs-transforming-medicine-80258

The process to get a biosimilar FDA-approved is also more complicated than getting a simple generic approved. Rather than simply testing a chemical to ensure it is the same, biosimilars must be proved to function clinically similarly to the original biologic. The process of getting a biosimilar approved, then, is almost as difficult as filing a new drug application.

But because biologics rake in so much money, there is still motivation for companies to manufacture biosimilars. While the first biosimilar to enter a market does not get its own period of exclusivity (meaning that other biosimilars can also enter the market as they are approved), the first biosimilar is typically priced almost as high as the reference product—in this case, Humira. The largest drop in drug prices usually occurs when the second biosimilar or generic enters a market and all three drug products (the reference product and the two biosimilars) begin competing on cost.

Because Humira is such a high-grossing drug, AbbVie has coasted on its success for years. Although AbbVie has other drug options in its pipeline, these drugs weren’t set to mature to market in time for Humira’s original patent to expire in 2016. Instead of waiting out the bust cycle, AbbVie turned to various techniques to keep Humira competitors off the market.

As Humira approached the end of its initial patent period and competitors began preparing their biosimilars, AbbVie lawyers constructed an dense patent thicket. Because the biosimilar approval process involves a complicated “patent-dance,” or process of reconciliation between the company with the reference product and the company with the biosimilar, the blanket of patents threw up obstacles that blocked biosimilars from entering the Humira market. In the words of a current lawsuit against AbbVie by the city of Baltimore, “few, if any, companies could litigate all of AbbVie’s patents; indeed, few could even parse through the morass of patents to determine whether any were valid and infringed.”

AbbVie’s intentions with the patents were clear. Many of the patents were for changes so slight that they barely constituted innovation, like minute switches in the solvent for the drug. Even still, AbbVie’s EVP of finance and administration couldn’t resist making it explicit at the 2014 Goldman Sachs Healthcare Conference:

“The bulk of that IP strategy, although there’s a lot of strategies in there, is designed to make it more difficult for a biosimilar to follow behind you and come up with a very, very similar biosimilar.”

One corporation, though, Amgen, came close to launching its biosimilar product in the U.S. AbbVie and Amgen, according to the Baltimore lawsuit, engaged in the patent reconciliation process. But then the two corporations suddenly settled. Although the terms of the settlement are sealed, the two corporations’ press release suggests that AbbVie granted Amgen access to the European market while blocking access to the U.S. market for 5 additional years.

Under terms of the agreement, AbbVie will grant patent licenses for the use and sale of AMGEVITA/AMJEVITA worldwide, on a country-by-country basis, and the companies have agreed to dismiss all pending litigation. Amgen expects to launch AMGEVITA in Europe on Oct. 16, 2018, and AMJEVITA in the United States on Jan. 31, 2023.

Strikingly, under this framework, AbbVie was the entity granting patent licenses and controlling drug market entry, not the U.S. Patent Office or the FDA, long after its original patent expired. In other words, AbbVie has leveraged the complicated regulatory law surrounding biosimilar patenting for its own benefit—and by letting AbbVie’s patent thicket happen, regulators are allowing AbbVie to usurp government agencies.

And AbbVie didn’t stop with Amgen. It also “granted access” to another eight companies, staggering dates of access to the U.S. market in the order of the requests received.

Chart source: https://law.baltimorecity.gov/sites/default/files/Complaint%20-%20Mayor%20v%20Abbvie.PDF

AbbVie’s most recent settlement, with Boehringer Ingelheim, allows the company to begin selling its biosimilar in the U.S. on July 1, 2023. Boehringer Ingelheim skipped the line ahead of companies that settled sooner—perhaps because Boehringer Ingelheim also agreed to pay royalties to AbbVie for the privilege of licensing its many patents.

AbbVie’s control over Humira distribution extends beyond the U.S. Another lawsuit, filed on behalf of UFCW Local 1500 Welfare Fund, a large grocer union in New York, alleges that AbbVie and other corporations conspired to divide up the U.S. and European markets for Humira. The European patent regime is more difficult to blanket with patents, so AbbVie gave up its monopoly hold over Europe to competitors, while keeping the U.S. market for itself. Competitors like Amgen were “permitted” by AbbVie to sell in Europe, but they were blocked from the U.S. until 2023.

The European market has already benefited from this price competition between Humira and adalimumab biosimilars. Before competition entered the market, the British National Health service was spending around $487 million a year on Humira. Only a year after AbbVie decided to allow biosimilar competition in Europe, though, the British National Health Service announced that it had already saved almost $135 million, savings of almost 30%.

The current court cases against AbbVie are vital for the future of not just Humira patients, but all biosimilar patients. If AbbVie’s strategy of holding competing biosimilars hostage holds up in court, other corporations will undoubtedly deploy the same tactics. And if the U.S. Patent Office continues to take a laissez-faire approach to patent thicketing, its power will be utterly eroded by private actors with no sense of duty towards patients.

Biosimilars are a relatively new category of drug, but the monopoly tactics AbbVie is using have long been a problem. As the corporation games the patent system in plain sight, to the detriment of patients across the U.S., we’re left anxiously watching to see if the courts and regulators preserve their role in protecting U.S. patients and bring this strategy to a halt.