How OBBB might make it harder to become a doctor

It's not just the Medicaid cuts

On July 4, President Trump signed the One Big Beautiful Bill (OBBB) into law. This law has many repercussions — including major cuts to Medicaid that will impact coverage and rural hospital viability — but a big one is how it is restructuring federal grad school loans.

Medical school has never been a hugely attractive proposition from a financial perspective, as graduates take out an average of over $200,000 in debt, which takes years to pay off. Residency is notoriously poorly paid (an average of $63,000/year for first year residents), leaving these students reliant on a higher paying job at the end of training, as well as low interest loans with the possibility of forgiveness through public service loan forgiveness (PSLF) programs.

As a general rule, the more specialized a physician, the higher their salary. Doximity’s 2024 Physician Compensation Report included the following graph, showing that surgeons and oncologists tend to command the highest salaries, while pediatric and primary care doctors are at the lower end of the spectrum. These salaries are all well above the average salary in the U.S., but the incentive to specialize — especially if you’re carrying hundreds of thousands of dollars in debt — is clear.

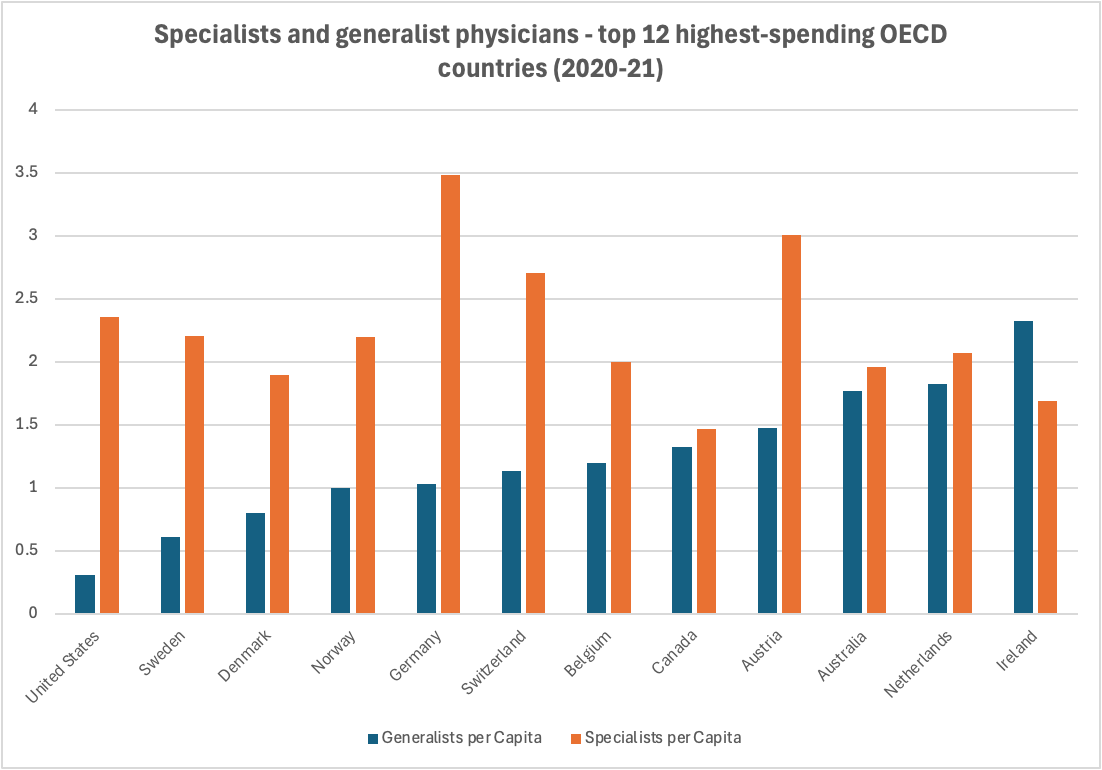

As a result, the U.S.’s physician workforce is already heavily weighted toward specialization, especially compared to other OECD countries. The gap between supply and demand of primary care doctors is expected to increase, as the Association of American Medical Colleges (AAMC) anticipates a shortage of up to 20,000-40,000 primary care physicians by 2036.

Shortages of primary care physicians disproportionately affect non-urban areas, where specialists are less likely to locate, and where residents are in need of the kind of triage that primary care doctors perform.

Before

Before OBBB, the typical med or dental student funded their education through a combination of Direct Subsidized and Unsubsidized Loans and Direct PLUS loans (also called grad PLUS loans). Direct Subsidized and Unsubsidized Loans had a cap depending on the student’s situation, but they had better terms than Direct PLUS loans, so most students maxed out the Direct Subsidized and Unsubsidized Loans they were eligible for before they took Direct PLUS money.

Direct PLUS loans allowed students to borrow for an amount equal to the total cost of the school, minus any financial aid received, which made them an appealing option for high priced graduate education, albeit with higher interest rates than Direct Unsubsidized Loans. With willing and able parents, grad students could also benefit from Parent PLUS loans, which their parents could take out on their behalf.

Now

The law phases out Direct Subsidized Loans and Direct PLUS loans for graduate students, and it caps the amount that can be borrowed through Direct Unsubsidized Loans far below the cost of most graduate schools. It also caps the amount that parents can borrow through Parent PLUS. Meanwhile, the administration has been toying with altering the terms for PSLF, as it tries to remove some nonprofits from eligibility (what this will mean for PSLF in the end is still unclear).

So now what?

The bad news

Primary care and rural healthcare are already suffering in the U.S., and OBBB is likely to heighten existing shortages as potential medical school candidates pursue more financially viable careers or focus on specializing.

In general, OBBB’s loan changes are likely to reduce the number of underprivileged or nontraditional medical school graduates, as students without existing resources are more likely to find medical school increasingly unattainable. Students from rural areas are more likely to locate in those rural areas after graduation, and OBBB may reduce those numbers.

Students who desperately want to be doctors are more likely to find private loans to help them achieve their goals, and these loans are more likely to have higher interest rates and fewer borrower protections. With the Consumer Financial Protection Bureau (CFPB) shrinking and losing power under this current administration, these students are more likely to be exposed to potentially predatory loan terms.

The potentially positive news (over the longer term)

Graduate school becoming hugely expensive was a problem before OBBB, and most policies have focused on subsidizing demand rather than capping the cost — or increasing the supply — of these schools. Granted, these schools are largely private institutions that can do what they want, but if they recognize that their student population can no longer afford their education, they may lower the prices. (This is less likely to happen with osteopathic schools, which are private and, unlike most MD schools, aren’t tied to university systems with endowments and foundations.)

Over-priced and predatory schools exist, something I’ve seen mentioned especially in the world of dentistry.1 The loan changes may force these schools to prove their job placement rates or lower their costs in a way that may protect some students from predation.

Some medical schools like NYU have been experimenting with providing free tuition as a result of big donations from private individuals. I think this is unlikely to become a large-scale approach to medical school, but perhaps a few more schools will take this tack, especially to encourage underprivileged students or those committed to primary care or practicing in a rural area.

This 2019 WHYY interview quotes the deans of Harvard and NYU’s dental schools as blaming debt on the students’ lifestyles. The dean of Harvard’s dental school actually says that complaints about the price are “sour grapes,” which I can’t believe the PR team let him say.

A fantastic analysis of the symptoms. But we need to talk about the disease.

This isn't just a bad bill. This is a hostile takeover of our nation's health.

First, they made it impossible for small-town family doctors to survive, forcing them into massive hospital systems. Now, they're making it impossible for anyone without a trust fund to even become a doctor.

This is a deliberate strategy by the corporate state. They are cutting off public loans to force a generation of aspiring doctors into the arms of private banks and predatory lenders—the very same Wall Street firms that own the politicians who passed this bill.

They are engineering a crisis. A nation without its own doctors is a nation dependent on their system. A nation where only the rich can afford to heal is a nation broken in two.

This is The People vs. The New East India Companies, and they have just launched a direct assault on our ability to care for our own.

An insightful read, thank you, Olivia