The future of the hospital

Does hospital-at-home signify the coming of a new model? Or is it just another program to dabble in?

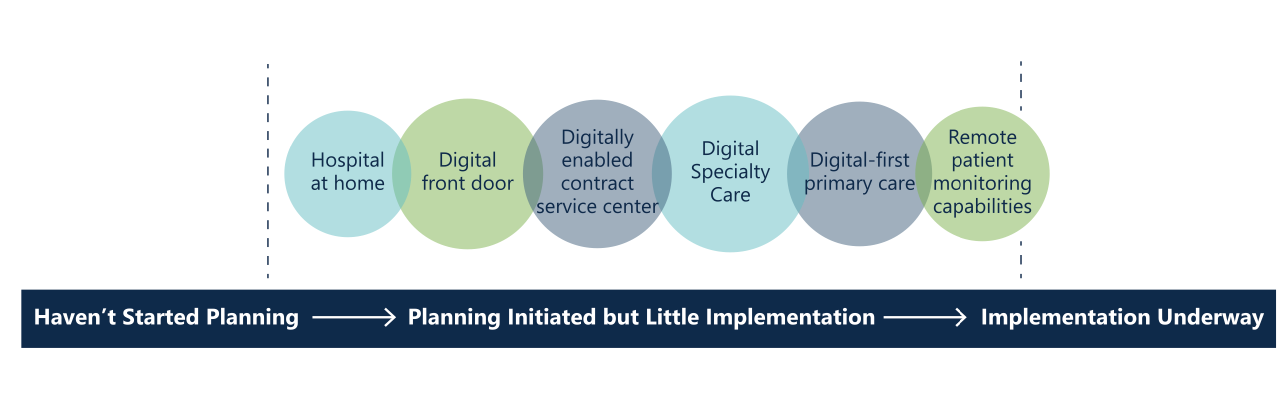

According to a recent report by the Chartis Group (which I also covered in a piece published two weeks ago, which kind of acts as part 1 of this newsletter), a majority of health systems are ideating about technological programs, including hospital-at-home.

But, as you can see above, hospital-at-home remains firmly in the wishful-thinking stages for all but a few hospitals.

During the pandemic, CMS gave hospital-at-home a kickstart by implementing a waiver that allowed Medicare coverage for acute hospital-at-home for the duration of the pandemic public health emergency. (As with many other pandemic-related policy shifts, it’s unclear what will happen with this waiver after the public health emergency ends.)

Under this waiver, hospital-at-home programs can bill fee-for-service, using the existing DRGs used for traditional inpatient hospital care. Bolder health systems have also contracted with private insurers to do hospital-at-home using risk-based payment models.

It’s too early to measure how financially successful hospital-at-home programs are, both because the programs haven’t been around for long and because, as a 2021 article in the American Journal of Managed Care points out, an accurate measure of costs for the hospital-at-home model is still lacking.

A shift in model

The need for an altered strategy

Determining the long-term financial viability of hospital-at-home is even more complicated given that much of the potential savings for a model like this, according to the Commonwealth Fund, is in avoiding the overhead of operating a hospital. In other words, for hospital-at-home programs to save money as a whole, health systems will likely have to alter their strategy away from capital infrastructure and towards a devolved, more technologically advanced home health program.

Given that health systems have, by and large, spent the last decade investing heavily in infrastructure projects, I’m skeptical that health system leadership is willing to take the risk of a smaller footprint.

As I argued in my telehealth piece from two weeks ago,

Health systems can optimize for a few things, none of which are entirely mutually exclusive, but all of which require a different strategy: Patient satisfaction, revenue, visit capacity, provider satisfaction, and customer acquisition (and I’m sure there are others).

Instead of choosing one of these goals, health systems seem to be firing wildly at telehealth options, offering a software that’s challenging for everyone to use, not making it clear when a patient should opt for telehealth instead of in-person or even publicizing that there is a telehealth option, charging facility fees for remote visits, and setting up a system that requires doctors to perform a confusing mix of telehealth and in-person (rather than, say, building a workflow that alternates telehealth and in-person days).

So far, it seems like hospital-at-home programs are happening in a similar way.

Why hospital-at-home might be different

However, there are two major differences that might make hospital-at-home a more viable strategy than health systems’ scattershot approach to embedded telehealth.

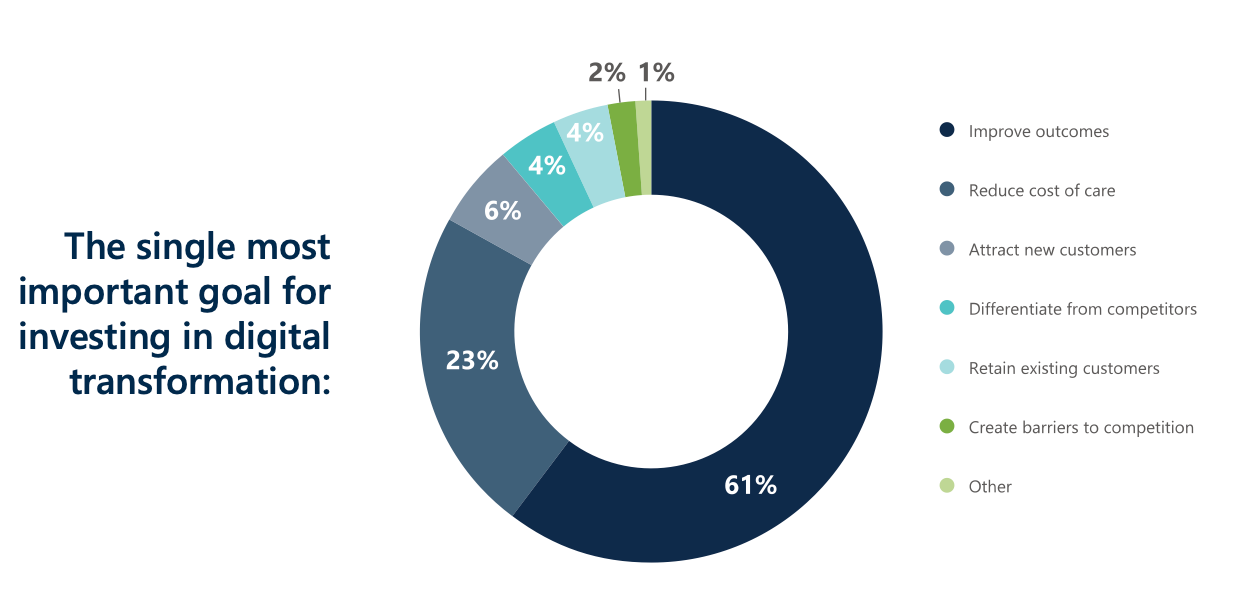

First, hospital-at-home programs seem to align more logically with health systems’ goals than telehealth does. As the Chartis Group found, health systems are most interested in “digital transformation” because of the potential to improve outcomes. It’s quite unclear how hospitals expect telehealth to carry that burden, but hospital-at-home has the potential to make a real difference in outcomes. If improving outcomes are truly a goal for health system leadership, investing in hospital-at-home seems much more impactful than trying to integrate telehealth.

Second, health systems have a near-monopoly on acute care. Companies focused on hospital-at-home necessarily have to partner with health systems, yoking the two together. Telehealth, on the other hand, is much more consumer-oriented, the major companies offer DTC options, and health systems are just one of many partners that commodity telehealth companies can choose to work with.

At least the way I see it, hospital-at-home programs are more likely to succeed than embedded telehealth models because health systems can benefit from innovative companies helping them figure out implementation, workflow, and go-live, help that they surely need for a program as complex as hospital-at-home.

Conclusion

In short, I’m hopeful about hospital-at-home making an impact on the hospital experience. I’m also excited about how, if hospital-at-home takes off, health systems have the potential to reinvent how hospitals function. Imagine, rather than a single hub or series of hubs, a model of dispersed emergency rooms, outpatient offices, and ASCs, tied together with a shared record, telehealth, and a hospital-at-home program to support patients upon discharge from the ER. Not only would these entities be more geographically accessible, but the system would have to be interoperable and communicative (at least in my idealized version).

Is hospital-at-home going to force this shift? I highly doubt it. But…maybe the process of implementing hospital-at-home helps the most innovative health systems start to imagine what a devolved model could look like?

This information shouldn’t be taken as investment advice (obviously), and the opinions expressed are entirely my own, not representative of my employer or anyone else.

Like value-based care, we all can love the ideas and hope of what hospital-at-home will bring to the system. Having worked in the hospital, I’ve seen the patients hospitals would love to punt to home - but why couldn’t they? Often, the lack of social support or lack of community based support services prevented a safe discharge home. If we think about why hospitals save money, I think of the ideal use case for them - an unpaid family caregiver. If this person is in place, hospitals can discharge home to save costs on staffing, supplies, possibly meds, and food. That’s my fear of abuse of these programs. My hope is this model drives hospitals to have incentives to work better with community based programs. The pieces are all there - mobile X-ray, pharmacy delivery, home care, therapy, dialysis, transportation, care management - but the missing piece is a lead to be paid to coordinate all these pieces for the patient. The payment has not been high enough to incentivize any change or working together. All policies and admin seem to focus on is cost savings but saving money has yet to create sustainable ideas in healthcare.

Right now most of the discussion and implementation of H@H programs is from the institutional perspective of shifting low-to-medium acuity patients to the home, which I'm all for and makes complete sense. Where I believe (and hope) the real opportunity lies is with independent providers -- not the hospital health system as you describe here -- but in private care delivery companies in partnership with MA Health Plans providing H@H services. As of now the CMS waiver does not work with this particular opportunity. My company wants to provide an integrated ecosystem of care for older adults at home throughout their entire care journey -- from Primary Care, to Acute Care (Urgent Care & H@H), Post-Acute Care (think of SNF@Home) and Palliative Care.