To the moon

The rapid growth of digital health funding

I’ve officially had this newsletter for a year. I’m so grateful for everyone who’s stuck around for all or part of that, and for everyone who’s shared this newsletter or offered feedback.

If you have a minute, please take this very short survey I put together. It’s just 6 questions, some multiple-choice, and all anonymous. More detail is more actionable on my end—but if you only have time to answer the first multiple-choice question, I’ll still be very grateful.

Again, thank you all so much.

An influx of cash

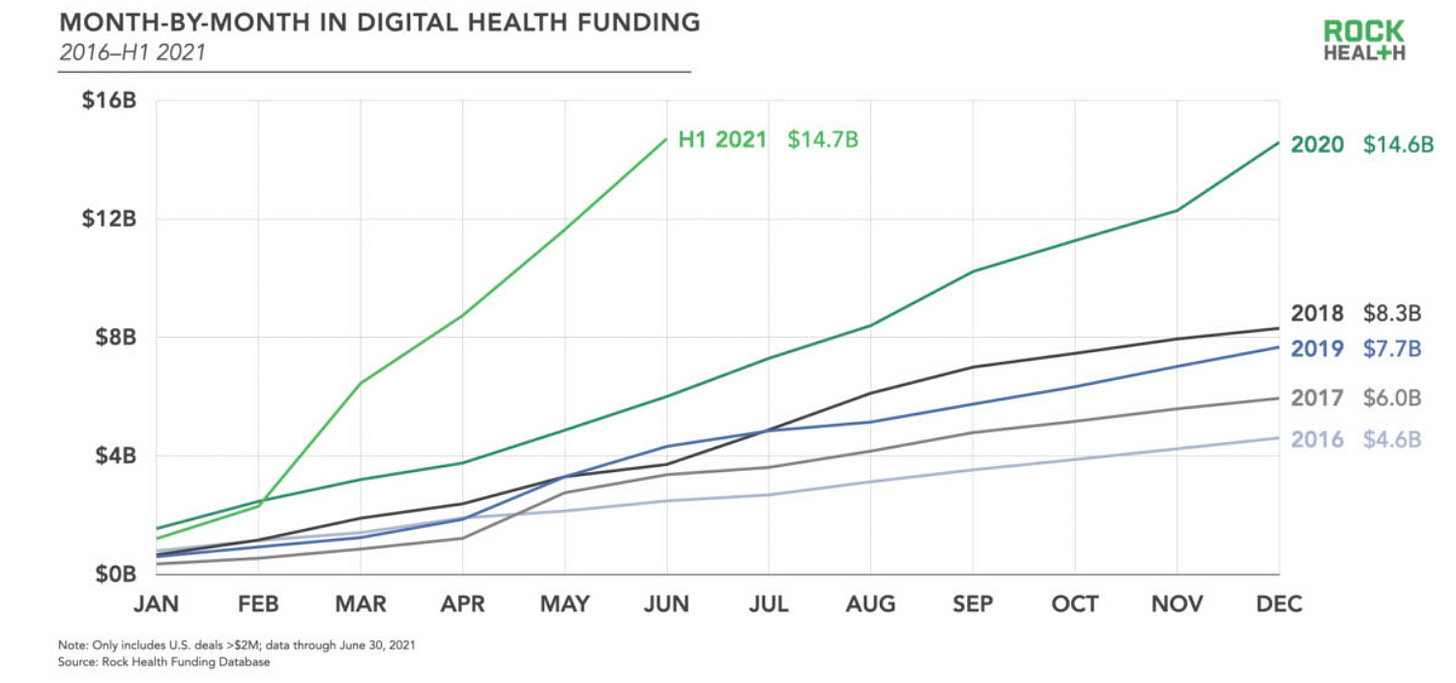

Digital health funding is at an all-time high, and there’s no sign of it slowing down. According to Rock Health data, funding has increased every year, with the most significant rate of growth happening in the first half of 2021.

In fact, by halfway through 2021, the digital health industry had already received more funding than in all of 2020.

The balance of funding is also shifting. Historically, healthcare funding was heavily weighted toward pharmaceuticals and medical devices, items that needed heavy investment and were likely to see high margins. But in the last few years, venture firms have started funding more companies offering healthcare services.

What’s happening?

There are a few factors behind this growth.

Increased maturation of the digital health market

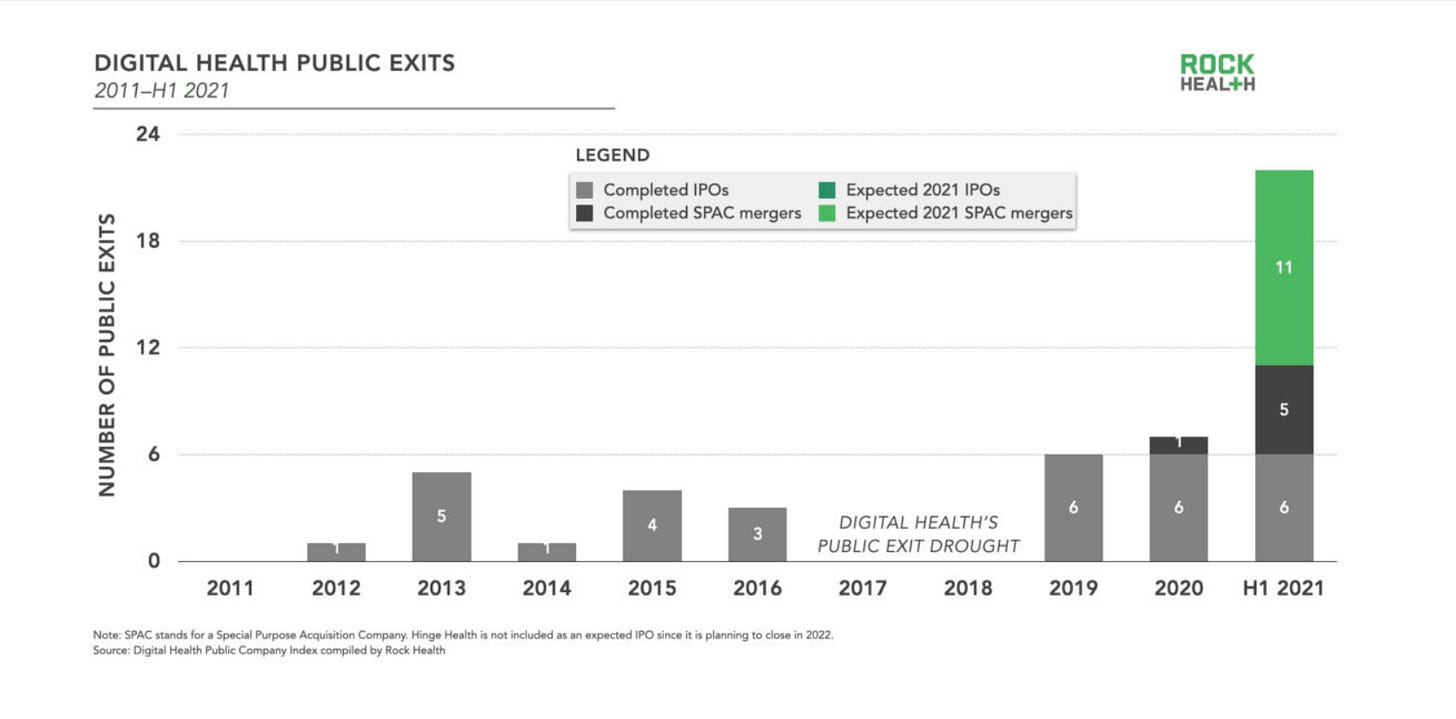

Digital health companies have really grown up in the last few years, with companies expanding into new services and gaining acceptance from incumbents—most importantly, payors and employers—more rapidly than in the past. And as the market has grown, digital health exits have become far more frequent.

The positive feedback loop of increased funding and more frequent successful exits signals that digital health is—after years in the desert—finally a mature area of investment.

However, as I talk about in the next section, I think the prevalence of SPAC exits is a sign that the market still has some growing up to do.

COVID-19

The catalyst for this record-breaking year of digital health funding was undoubtedly the COVID-19 pandemic. This gray swan event demonstrated how crucial healthcare is to normal life in the U.S.—as well as how much of the healthcare system is broken. Healthcare workers were struggling to find PPE, hospitals were struggling to source oxygen, and patients couldn’t figure out when to go to the hospital vs. when to stay home. It was impossible not to watch the breakdown and wonder how it would be different with a more innovative, more resilient healthcare system.

In addition, telehealth was suddenly essential, rather than something reserved for a few early adopters paying out of pocket. Telehealth usage rates skyrocketed, and the service started to look like a key part of any healthcare company—digital or not.

Tiger Global

The Rock Health H1 funding report also counts Tiger Global as a key player in the growth of venture capital dollars being infused into the system. Tiger is throwing around so much money that it’s changing the denominator.

(I’m pretty weirded out by Tiger’s strategy. It seems big and splashy in a way that courts a Wall Street Journal investigation in a few years. But I could be wrong.1)

Is this a bubble?

In short: I don’t think so. I expect this amount of digital health funding to continue and even increase.

The market has matured dramatically, far past the days when the only digital health unicorns were Flatiron and Oscar. Now those companies have joined the ranks of healthcare incumbents, while still maintaining their aura of innovation and value. I expect many of today’s healthcare unicorns to see similar success.

But: despite this maturation, for the new crop of healthcare companies to really have impact, I think the prevailing exit strategy has to mature.

A large percentage of the recent digital health exits have been through a SPAC. This isn’t a viable long-term strategy. Not only is the SPAC vehicle likely to see increased regulation soon, it also feels wrong for these companies to bill themselves as more transparent and innovative than the traditional healthcare system and then hit the public markets with a vehicle designed, it seems, to evade traditional oversight.

(An essential caveat here that I suspect the reason the SPAC has gained so much popularity is less that these companies are trying to evade oversight and more that (1) SPACs are popular right now and (2) investors are probably pushing the model while it’s hot. But still, I think it’s a bad look for the digital health market as a whole.)

Conclusion

Someone once described me as a “healthcare groupie,” which—while mildly insulting?—isn’t wrong. And so it’s been thrilling to watch such a dramatic maturation of the market in just a few years. Patients looking for condition-specific care have more options than ever. Doctors can use telehealth to reach patients who otherwise wouldn’t have been able to access care. Hospitals are increasingly having to compete on software, bringing them into the future (of course “future,” for hospital software, is unfortunately somewhere around 2008, but it’s something). It’s also exciting to watch investors realize that healthcare is worth investing in, and that innovation is slow but possible.

I’m looking forward to what the next year brings us.

This information shouldn’t be taken as investment advice (obviously), and the opinions expressed are entirely my own, not representative of my employer or anyone else.

In general, I think blitzscaling is outdated—specific to SaaS companies from the early 2000s-2010s, when other companies could swoop in with the exact same idea, giving value to rapid growth at the cost of all else.

Healthcare is complex enough and there are enough problems to solve that the blitzscaling/blitzfunding idea doesn’t really add up for me. But that’s just my take. This is the most compelling defense of Tiger I’ve seen.